FDIC INSURANCE IS NOT SO LIMITING

Account balances over $250,000 can be fully FDIC insured with the convenience of one account. There are two ways to secure FDIC coverage beyond the standard limits for your Jumbo Deposit Account. You choose the option that works best for you.

1. Joint accounts and different ownership categories:

FDIC insurance limits are calculated by account category for each individual account owner. Depositors often find that they qualify for a lot more FDIC insurance than they expect, sometimes for millions of dollars – without going to multiple banks.

More On Joint Accounts and Categories

Coverage Limits1

The standard FDIC insurance limit is $250,000 per depositor, per insured bank, for each account ownership category. The FDIC provides each account owner separate coverage for deposits held in different account ownership categories, so depositors may qualify for coverage well over $250,000 if they have funds in different ownership categories, such as joint, pay-on-death and Trusts. FDIC’s Electronic Deposit Insurance Estimator is an online tool to calculate FDIC insurance coverage.

FDIC Deposit Insurance Coverage Limits by Account Ownership Category

| Account Ownership Category | FDIC Insurance Coverage Limits |

|---|---|

| Single Accounts (Owned by One Person) | $250,000 per owner |

| Joint Accounts (Owned by Two or More Persons) | $250,000 per co-owner |

| Certain Retirement Accounts (Includes IRAs) | $250,000 per co-owner |

| Revocable Trust Accounts | $250,000 per owner per unique beneficiary |

| Corporation, Partnership and Unincorporated Association Accounts | $250,000 per corporation, partnership or unincorporated association |

| Irrevocable Trust Accounts | $250,000 for the non-contingent interest of each unique beneficiary |

| Employee Benefit Plan Accounts | $250,000 for the non-contingent interest of each plan participant |

| Government Accounts | $250,000 per official custodian (more coverage available subject to specific conditions) |

1 All information in this section are taken directly from the FDIC

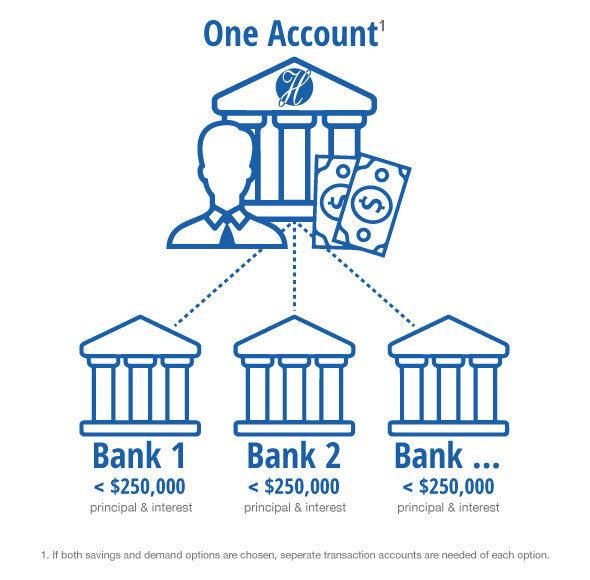

2. IntraFi Cash Service® (also known as Insured Cash Sweep or ICS):

A single account owner can access multi-million-dollar FDIC protection with ICS and a Jumbo Deposit account. When you sign an ICS Deposit Placement Agreement, funds are placed with different FDIC insured banks through the ICS network. Yet, you receive one consolidated statement and interest payments through Heritage Bank.

More On ICS:

When you use ICS through Heritage Bank, here’s what happens:

- You sign an ICS Deposit Placement Agreement and a custodial agreement with Heritage Bank.

- You establish a Jumbo Deposit Account to manage your ICS funds.

- Your funds are automatically placed into deposit accounts with other members of the ICS Network in accordance with the Deposit Placement Agreement, ensuring they are FDIC insured.

- You can monitor your funds at all times using Heritage Bank’s online banking program.

- You receive consolidated interest payments and one monthly statement for all of the money you have invested through the ICS network.

There are FDIC coverage benefits to adding beneficiaries to your account.