Phishing scams are on the rise, targeting individuals and businesses alike, often leaving victims in financial ruin. For online banking users and security-conscious individuals, understanding and preventing phishing attacks is critical to protecting one’s financial future. Ruth McDonnell discusses how you can safeguard your financial future in the KWLM Ask the Expert segment.

This guide will equip you with the tools and knowledge to recognize phishing attempts, protect your information, and take action if you suspect fraudulent activity. Together, we will walk through the types of phishing attacks, share insight into local phishing trends in Minnesota, and provide practical prevention tips you can use today.

Understanding Phishing

Phishing is a type of cybercrime where attackers pose as legitimate entities to trick individuals into sharing sensitive information like passwords, credit card details, or Social Security numbers.

Common Types of Phishing Attacks

Email Phishing – Fraudulent messages disguised as trusted organizations (e.g., banks, retailers) aim to steal account credentials or financial data.

SMS Phishing (“Smishing”) – Scammers send fake text messages, often containing malicious links or urgent prompts like “Your account is locked. Verify here!”

Voice Phishing (“Vishing”) – Attackers call victims, claiming to represent banks, government agencies, or other trusted entities, to extract sensitive information via phone.

Phishing attacks prey on urgency and fear. Understanding how they work is the first step toward building a strong defense.

Local Statistics and Trends in Minnesota

Minnesota has not been immune to the surge in phishing attacks. The state has experienced a notable increase in cybercrime over recent years, impacting local businesses and individuals alike.

- A Federal Trade Commission (FTC) report ranked Minnesota in the top 10 states for fraud-related complaints.

- The Minnesota Department of Public Safety identified phishing as a leading method of identity theft in the state.

- Cybercrime targeting small businesses and nonprofits has also escalated, often resulting in financial and reputational damage.

Keeping an eye on phishing trends in your region ensures you stay vigilant against evolving threats.

Recognizing Phishing Attempts

Spotting a phishing attempt can make the difference between security and being scammed. Here are critical signs to watch for in emails, texts, and calls claiming urgency or legitimacy:

- Generic Greetings: Credible entities usually address you by name rather than “Dear customer” or similar terms.

- Misspelled URLs or Suspicious Domains: Double-check whether the website link matches the sender’s legitimate domain. For example, beware of addresses like “your-bank-secure-login.info”.

- Grammar and Spelling Errors: Genuine companies proofread their communications carefully.

- Requests for Sensitive Information: Legitimate institutions rarely, if ever, ask you to share account details or passwords via text, call, or email.

- Too-Good-to-Be-True Offers: If an offer or reward seems unrealistic, it probably is.

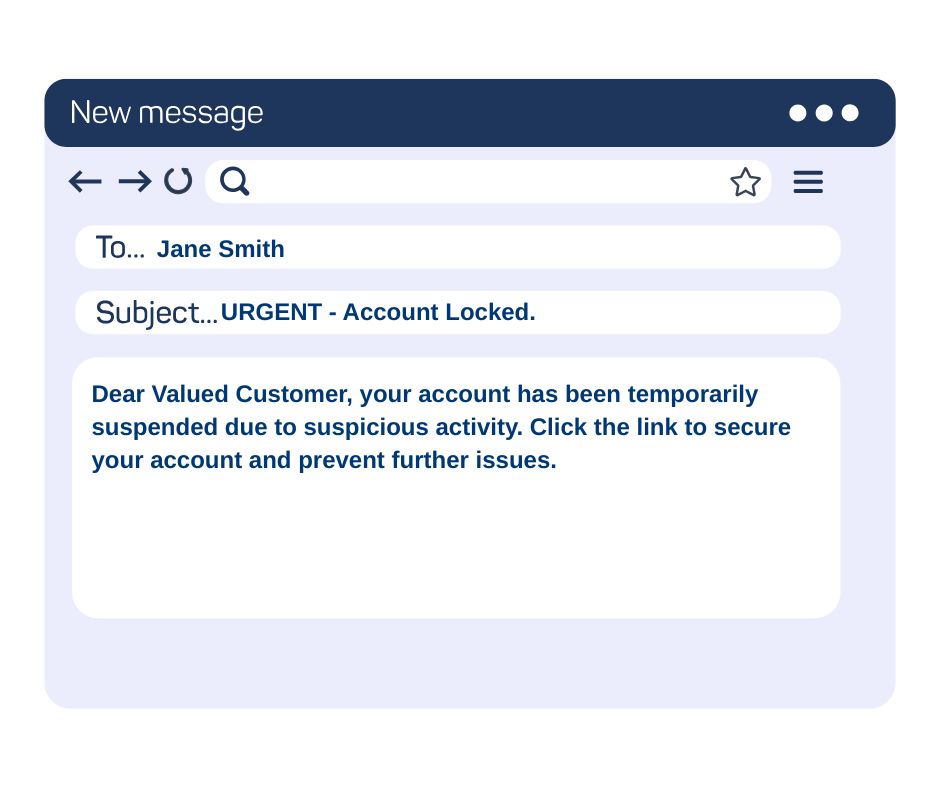

Example of a Phishing Message

Always approach such messages with skepticism.

Preventive Measures

Scam prevention begins with fraud awareness and proactive strategies. Here are essential tips for avoiding scams and safeguarding sensitive information.

Be Wary of Unsolicited Messages

- Be skeptical of unexpected emails, texts, or calls asking for personal details.

- If unsure about the sender’s legitimacy, contact the organization directly using their official contact information.

Verify Through Trusted Channels

- Do not click on links or attachments in unsolicited messages. Instead, visit the entity’s official website or call their customer service number.

Enable Stronger Security Measures

- Use strong, unique passwords for online banking and email accounts.

- Enable multifactor authentication (MFA) whenever possible to add an extra layer of security.

Safeguard Personal Information

- Avoid sharing sensitive details online unless necessary and secure.

- Regularly review account activity and statements for unauthorized transactions.

Phishing prevention relies on vigilance, so always think twice before sharing data online.

Tools and Resources

There is no need to tackle phishing risks alone. Numerous tools and resources can help protect your financial information and give you peace of mind.

Local Resources in Minnesota

- The Minnesota Department of Public Safety provides valuable cybersecurity updates and prevention tips.

- Better Business Bureau of Minnesota highlights common scams and phishing threats targeting local individuals and businesses.

Recommended Online Security Tools

- Password Managers (e.g., LastPass, Dashlane): Securely store complex passwords for all your accounts.

- Email Security Filters (e.g., Mimecast, SpamTitan): Block phishing emails before they hit your inbox.

- Antivirus Software (e.g., Norton, McAfee): Protect devices from malware embedded in phishing links or attachments.

What to Do If You Suspect a Phishing Attempt

Despite best efforts, you may encounter phishing attempts. Here’s how to respond effectively to minimize harm and protect others.

- Do Not Engage

Avoid clicking links, replying to messages, or downloading any attachments.

- Report the Attempt

- Forward the email or screenshot the message to [email protected].

- Notify Minnesota authorities via the Office of the Minnesota Attorney General.

- Alert Your Bank or Service Provider

- Contact your bank immediately if you suspect your account information is compromised.

- Heritage Bank customers can reach us Toll-Free at 1-800-344-7048 for assistance.

- Change Your Passwords

Update passwords for any accounts potentially linked to the phishing attempt. Use strong, unique combinations.

Stay Vigilant and Protect Your Future

Phishing scams and identity theft are unfortunate, but you can prevent unnecessary losses and stress with the right strategies. By recognizing phishing attempts, leveraging strong security measures, and utilizing local resources, you take active steps to safeguard your financial future.

For added peace of mind, Heritage Bank NA is here to help. Whether you have questions or need tips for staying secure online, we are just a call away. Stay informed, stay alert, and stay safe.

Helping People Succeed Financially. We see every customer as an individual and treat our customers’ businesses as our own. Our dedicated, experienced staff is there for our customers on every step of their journey.